Car Parts… On Sale?

Advance Auto Parts Logo

Advance Auto Parts (AAP) is a leading aftermarket auto parts retailer. They serve both do-it-yourself and pro customers with a 50% sales split between the groups. Advance is behind auto parts retailers AutoZone (AZO) and O’Reily Auto Parts (ORLY) in market share in the US. AAP is led by Shane O’Kelly, who was appointed CEO in September 2023. Shane has a robust background setup to lead a turnaround. He graduated from West Point Academy and later obtained an MBA from Harvard. Shane started his career at McKinsey & Company and most recently left his CEO position at the HomeDepot Supply to come to Advance. Joining Shane as the CFO was Ryan Grimsland, who also has a strong resume coming from Lowe’s as SVP in Strategy and Transformation and previously as VP in Global FP&A.

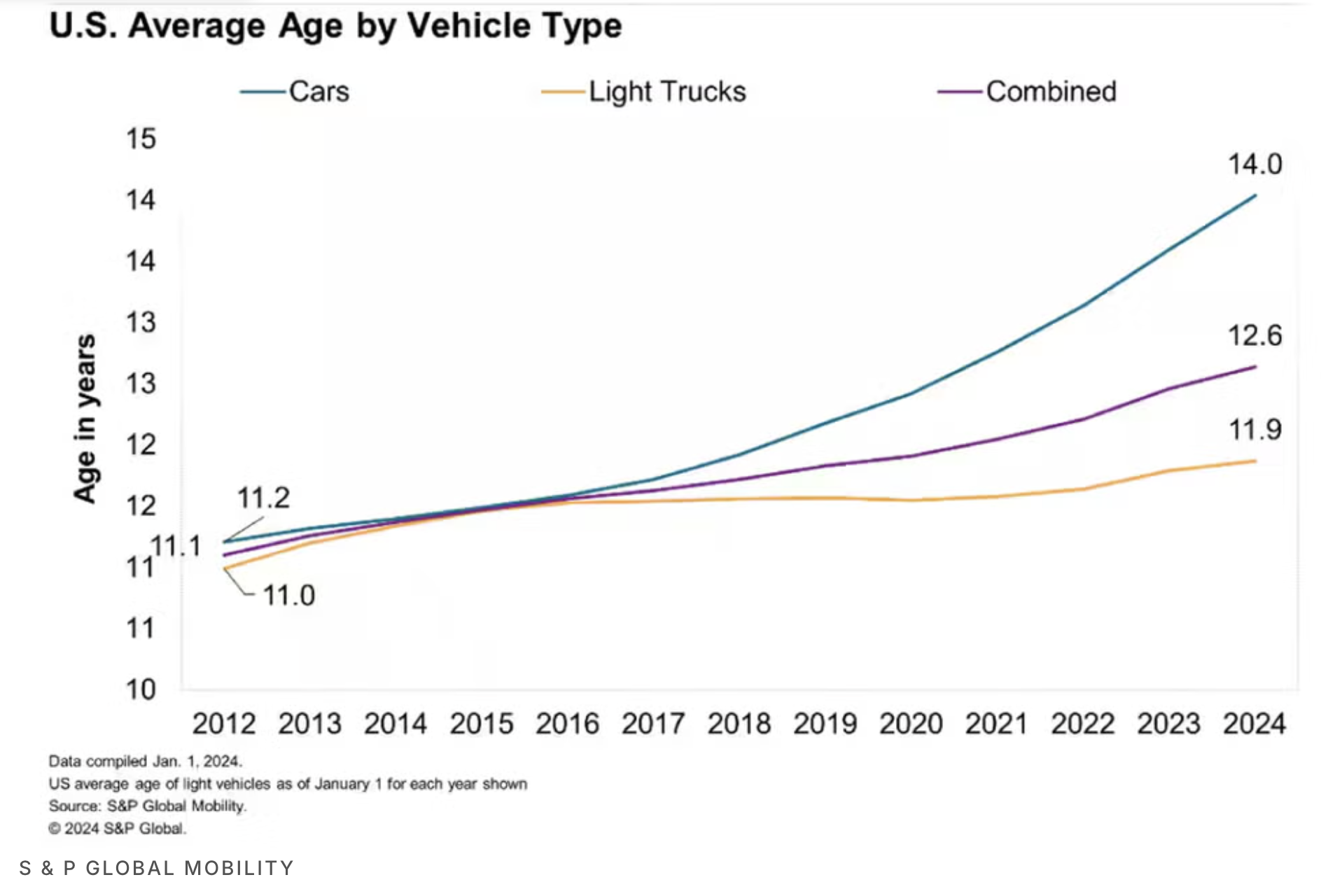

Car and Driver, S&P Global Mobility

We are all aware of the cost of vehicles today, very expensive. This has led to a rapid increase in the average age of a vehicle on the road in the US. It has become more economical to pay for maintenance of an older car then the purchase a new car. The average age of cars on the road has gone from 11.2 years in 2012 to 14.0 years in 2024. This increase is a beneficiary for the aftermarket auto industry, which AAP sits in.

“For the aftermarket sector, the aging US vehicle fleet represents a substantial opportunity. As vehicles reach the six- to 14-year window, they require more frequent maintenance, repairs and parts replacements. With the 2015-2019 model years now entering this prime age range, a wave of service demand is expected to hit repair shops, part suppliers and service providers across the country.” S&P Global

All of this while EV sales drop, coming in below prior expectations. The decline in EV sales can be partially attributable to the ending of the tax credit in September, 2025.

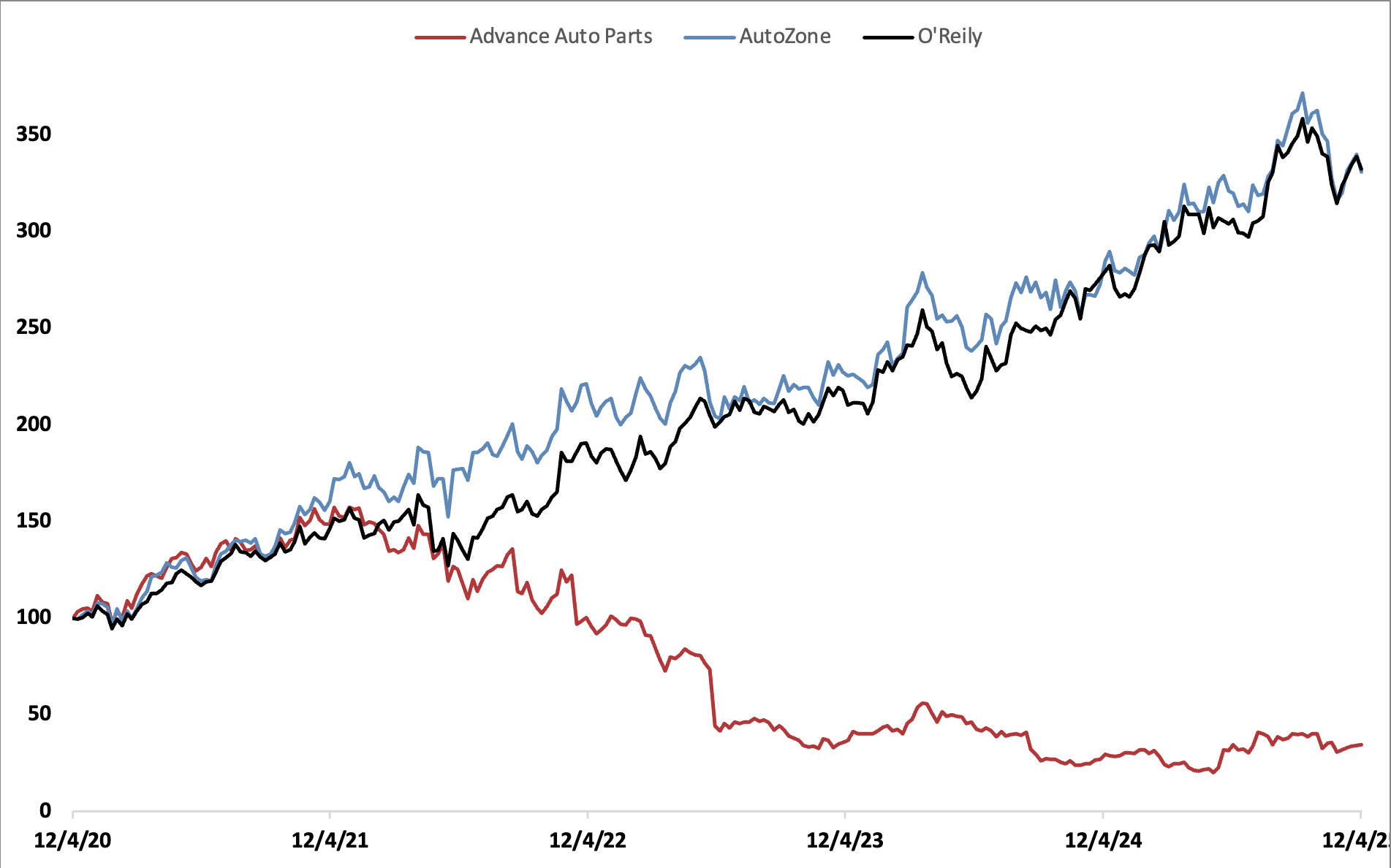

5 Year Price Performance (AAP, AZO, ORLY)

Over the past 5 years, AZO and ORLY have returned greater than +200%, while AAP has lost a gloomy -60% of its value. What caused this dislocation for companies that had been almost perfectly correlated?

AZO and ORLY where humming along while AAP was facing industry lagging sales growth and margin pressure. Specifically in Q3 2022, Advance saw same-store sales growth decline by -0.7%, while AutoZone reported same-store sales growth of 6.2% for the quarter ended August 27, 2022. This showed investors that Advance was losing market share dramatically to competitors. This trend continued into 2023 and led to major governance changes.

Shane and his team came to change this performance in late 2023. Their new initiatives cut the lower margin businesses on the west coast to focus on dominating in the east coast.

Q4 & FY 2024 Presentation

Advance recently completed the divestiture of its Worldpac wholesale business and accelerated the exit of underperforming stores, primarily on the West Coast. They are striving to be in first or second place in their target markets across the east coast, and this was a determining factor in exiting from the west coast where they did not have a competitive advantage. In total the company closed over 500+ stores, from 2024 to the beginning of 2025. This move increased balance sheet flexibility and strength for the next chapter. In 2025 they expect to open 30 new stores and 14 new market hubs. Net new store and market hub additions is the expected trend going forward.

To increase gross profit margins AAP is replacing Distribution Centers (DCs) with their market hubs model. Market hubs are oversized stores that both serve walk‑in customers and act as mini‑distribution nodes for 60–90 surrounding locations, typically tripling SKU count versus a standard store and enabling faster same‑day availability.They claimed in their most recent call that these market hubs increase surrounding stores gross margin by ~1%.

A key point emphasized in all of their recent earnings call is focusing on time to deliver parts to consumer. They want this time to be between 30-40 mins from over 50 mins in 2024. They view this as the sweet spot for meeting customer needs. Another key point is product availability. We all understand how frustrating it can be for a store to not be in stocked in the good you need. Advance wants product availability to be in the upper 90%s range and it was between 96% and 97% in Q3 2025. They understand how important a happy and satisfied customer is, and are implementing these key points to meet their goals.

How does this business stand up in the face of economic uncertainty? Well, only 10% of their business is discretionary, so 90% of purchases are not done for recreation and are necessary to get people from point A to B. This is a defensive-esque sector that can uphold in some tougher consumer times.

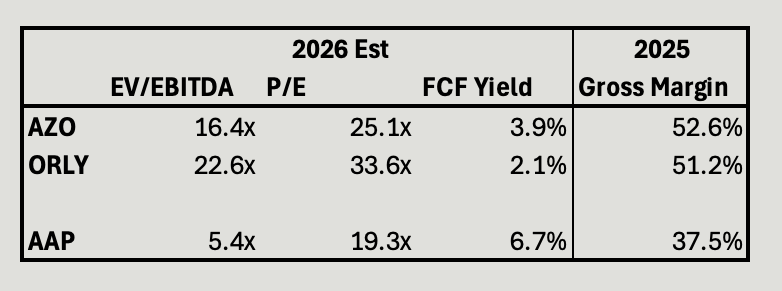

LSEG Estimates, McClure Private Wealth Internal Estimates

Advance trades on a steep multiple discount to peers, which was warranted due to the fall out they had from 2021-2023 and the collapse in gross profit margins. Looking into 2027, Advance believes they can achieve a ~7.0% operating margin which no one on the street is pricing in. The street expects operating margin to be ~5.0% in 2027 a 200 basis point difference.

We forecasted conservatively compared to managements guidance, estimating a 6.0% operating margin in 2027 and 6.4% in 2028. We are forecasting gross profit margins back into the 45% range in the same timeframe, which should boost the valuation multiple closer to an industry average.

Our exit multiple assumption applies a 30% discount to the peer‑group trading multiple to reflect AAP’s lower margins and execution risk.

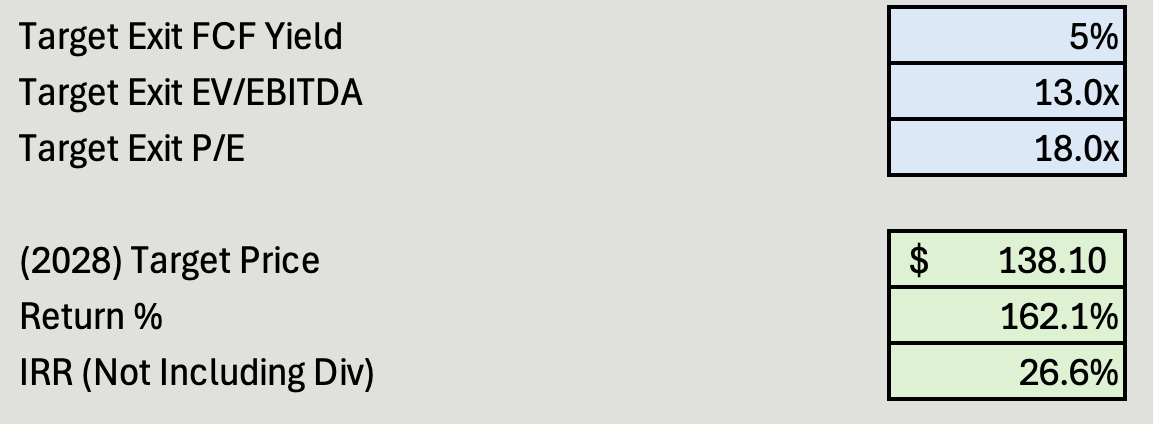

Our target for 2028 comes to ~$138 representing a total return of 162.1% from the closing price of $52.69 on December 2nd, 2025. The estimated IRR is 26.6% per year, which is very attractive when compared to a richly valued US stock market.

McClure Private Wealth Internal Estimates

Disclaimer

This article is for informational and educational purposes only and does not constitute investment advice or a recommendation to buy or sell any security. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for any losses or damages incurred as a result of reliance on the information provided herein.